Home Equity Loans: Key Comparisons

By Isabella Chalmers / Oct 23

What if you could unlock the potential of your home’s value to fund exciting projects or consolidate debts? Understanding home equity loans and lines of credit can empower you to make savvy financial decisions that enhance your quality of life. Let’s explore the essential takeaways from this topic!

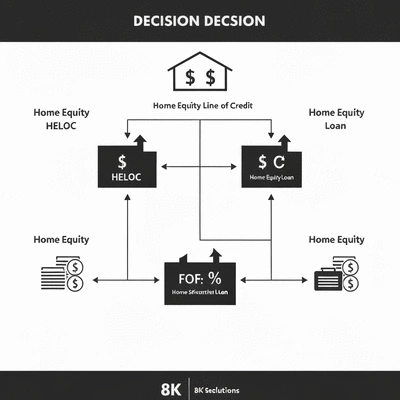

This visual outlines the key differences between Home Equity Loans and Home Equity Lines of Credit (HELOCs), helping homeowners make informed financial decisions. For a deeper dive into the basics, consider understanding home equity loans in detail.

Draw Period

Access funds, make interest-only payments.

Typically: 5-10 years

Repayment Period

Repay principal + interest; payments may increase.

Typically: 10-20 years

When it comes to tapping into the value of your home, understanding home equity loan products is key. These financial tools allow homeowners to leverage their property's value for various purposes, from renovations to debt consolidation. In this section, we'll explore the fundamental types of home equity options available, including home equity loans and home equity lines of credit (HELOCs). Let's dive in!

A home equity loan is a straightforward way to access the equity you've built in your home. Essentially, it’s a lump sum loan that you repay over a fixed term, typically with a fixed interest rate. This means you get a one-time payment based on your home’s equity, making it ideal for large expenses.

With a home equity loan, you can plan your finances confidently since you know exactly how much you’ll pay each month. This predictability can be especially beneficial if you're funding a one-time project, like a home renovation or major purchase.

Lump sum loans are designed for homeowners who need a specific amount of money right away. Some of the key features include:

The benefit of a lump sum is that you can make significant improvements or consolidate debts without worrying about fluctuating interest rates, which can often be a concern with other types of loans.

Fixed interest rates are a major advantage of home equity loans. This means your rate won’t change over the life of the loan, which provides stability and predictability in your monthly payments. If interest rates rise, you won’t be affected!

With fixed rates, you can budget more effectively and avoid surprises. This type of loan is particularly attractive if you anticipate a longer repayment period for your investments. Understanding how these rates function will help you make informed decisions that align with your financial goals, such as those discussed in financial tips for homeowners' equity.

Now that we’ve covered home equity loans, let’s turn our attention to the home equity line of credit (HELOC). Unlike a lump sum loan, a HELOC functions more like a credit card, offering borrowers access to a revolving line of credit based on their home’s equity.

This flexibility can be an excellent option for homeowners looking to finance ongoing projects or cover unexpected expenses over time. However, it’s essential to be aware of how these variables can impact your financial landscape.

HELOCs are particularly valuable for homeowners who want to manage costs as they go. They offer a unique combination of credit and financing, allowing you to draw funds as necessary.

Some typical uses for a HELOC include:

With a HELOC, you maintain control over how much you borrow and when, giving you the ability to adjust your spending based on your current needs.

One key aspect of a HELOC is its variable interest rate, which means your rate can change based on market fluctuations. This can be a double-edged sword—while it can start lower than fixed rates, it can also rise, potentially increasing your payments over time.

It’s crucial to understand how these changes can affect your budget. Monitoring the market trends and your own borrowing can help you mitigate risks associated with variable rates. Staying informed is essential!

HELOCs typically come with two phases: a draw period and a repayment period. During the draw period, you can borrow and repay the funds as needed, often making interest-only payments. Once this period ends, the repayment phase begins, where you’ll start repaying both principal and interest.

This transition can be a significant adjustment, so planning ahead is vital. Here’s a quick overview of the timelines:

Being prepared for these changes will help you manage your finances effectively and ensure you’re well-equipped to handle your expenses as they arise.

When considering a home equity option, take the time to thoroughly assess your financial goals and future plans. Understanding your long-term objectives can help you choose between a home equity loan with fixed payments or a more flexible HELOC. This proactive approach can save you money and ensure that your borrowing aligns with your financial strategy!

Choosing the right home equity option is crucial for maximizing your financial opportunities. At Equity Loan Hub, we understand the importance of making informed decisions, especially when it comes to leveraging your home’s equity. In this section, we'll explore the pros and cons of home equity loans and HELOCs, which will guide you in selecting the best fit for your financial needs!

To help you evaluate each option, let's take a look at some of the key benefits and drawbacks of both home equity loans and HELOCs. Understanding these can make your decision-making process much easier.

By weighing these pros and cons, you can better assess which option aligns with your current financial situation and goals. So, what are you leaning towards?

For a clearer visual representation, here’s a quick comparison table that outlines the main features of home equity loans and HELOCs:

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Loan Structure | Lump Sum | Revolving Credit |

| Interest Rate Type | Fixed | Variable |

| Payment Structure | Fixed Payments | Interest-Only Payments Possible |

| Usage Flexibility | Less Flexible | Very Flexible |

| Best For | Large, Immediate Expenses | Ongoing Expenses |

At Equity Loan Hub, we believe in empowering homeowners through the use of interactive tools. Calculators and comparison resources can be invaluable in making your decision.

Using online calculators can provide a quick snapshot of what your monthly payments might look like based on different loan amounts and interest rates. These tools can help you:

By taking advantage of these calculators, you can gain clarity and confidence in your borrowing decisions! To further assist, explore our home equity loan calculators reviewed.

When it comes to choosing between fixed and variable rate loans, knowing the differences is essential. Here’s a quick outline of what you should consider:

Ultimately, the choice between fixed and variable rates will depend on your comfort level with risk and your financial strategy. So, what’s your preference?

Here is a quick recap of the important points discussed in the article:

A: A home equity loan provides a lump sum with a fixed interest rate and predictable monthly payments, ideal for large, one-time expenses. A HELOC, on the other hand, is a revolving line of credit with a variable interest rate, offering flexible withdrawals and often interest-only payments during the draw period, suitable for ongoing expenses.

A: A fixed interest rate remains constant throughout the loan term, providing stability and predictability in your monthly payments. This makes budgeting easier and protects you from potential interest rate increases in the market.

A: During the draw period (typically 5-10 years), you can borrow funds as needed and often make interest-only payments. Once this period ends, the repayment period (typically 10-20 years) begins, where you must repay both the principal and interest, which can lead to higher monthly payments.

A: The primary risk is that your interest rate can fluctuate based on market conditions. While it might start lower than fixed rates, it can increase over time, potentially leading to higher monthly payments and making budgeting more challenging if not managed carefully.

A: Online calculators can provide estimates of potential monthly repayments and total interest paid for different loan amounts and interest rates. They help you compare various loan scenarios, offering clarity and confidence in your borrowing decisions by visualizing the financial impact of each option.

Home Equity Loans: Key Comparisons

What if you could unlock the potential of your home’s value to fund exciting projects or consolida

Home Equity Loans: Key Comparisons

What if you could unlock the potential of your home’s value to fund exciting projects or consolida

Home Equity Loan Calculators Reviewed

Have you ever considered how much potential lies within your home’s equity? Understanding home equ

Home Equity Loan Calculators Reviewed

Have you ever considered how much potential lies within your home’s equity? Understanding home equ

Home Equity Loans: Refinance vs Top-Up

What if you could unlock the potential of your home while financing your dreams? In 2025, knowing th

Home Equity Loans: Refinance vs Top-Up

What if you could unlock the potential of your home while financing your dreams? In 2025, knowing th